Given billions of dollars in unfulfilled loss on its Bitcoin investments, Strategy said on Monday that it is not anticipating a first-quarter income.

According to a filing with the Securities and Exchange Commission, the Tysons, Virginia-based company claimed the value of its Bitcoin assets dropped$ 5.91 billion on sheet in the first quarter.

The company warned that” we may not be able to restore success in future times, especially if we suffer significant unrealized losses as a result of our modern assets,” adding that a$ 1.69 billion tax benefit will help to offset the company’s unrealized losses in the first quarter.

Strategy’s investments remain unchanged at 528 and 185 Bitcoin, which is worth about$ 41.3 billion over the past week. Strategy spent$ 7.7 billion on Cryptocurrency in the first quarter, buying the property for an average of$ 95, 000 per gold.

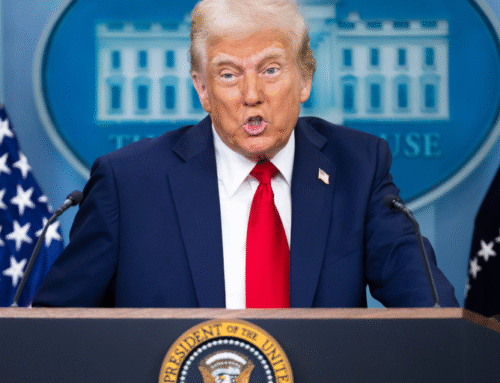

Currency’s price has fallen to a five-month small as a result of U.S. President Donald Trump’s tariffs have affected risk-on assets. According to blockchain data provider CoinGecko, the leading online resource was changing hands about$ 78, 200 at noon Eastern Day.

According to Saylor Tracker, Strategy has invested$ 35.6 billion in the resource since beginning to purchase it in 2020, purchasing it for an average of$ 67,485 per Bitcoin. Strategy is up about 16.5 % on its wager based on that typical Bitcoin value.

In addition to issuing products like convertible bill and permanent preferred stock, strategy has used$ 8.2 billion in debt to purchase more Bitcoin than it could then. Strategy is required to spend$ 146 million in payouts annually in addition to its so-called” Discord” and” Strike” services.

Strategy was known for its business analytics program business before it became a Bitcoin-buying system. The company claims that its business “has not generated positive cash flow” in recent years and may not support it fulfill its financial obligations.

Strategy stated that it intends to incur more debt, issue common shares, or hold more preferred stock offerings and convertible debt in order to fulfill its financial obligations.

Strategy hasn’t experienced a profitable quarter since the business, according to Macrotrends, posted earnings per share of$ 0.32 on$ 124 million in revenue in the fourth quarter of 2023.

Strategy shares dropped 10.6 % to$ 292, as of Monday, according to Yahoo Finance. Although significantly lower than the previous year’s peak of$ 543, it was still significantly above its Election Day price of$ 233.

Daily Debrief Newsletter

Start each day with the most popular news stories right now, along with original content, a podcast, videos, and more.