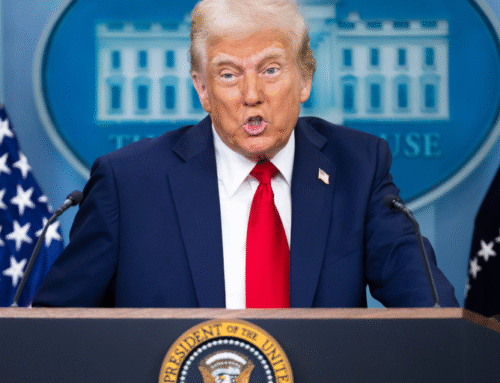

After a prolonged industry response to U.S. President Donald Trump’s fresh tariffs, according to economist and long-time Cryptocurrency critique Peter Schiff, crypto is “finally starting to split.”

He criticized Trump’s decision to impose taxes, which have caused global falls in digital assets and equities. The dumbest thing I thought Trump would do was set up a Strategic Bitcoin Reserve. I made a mistake,” he wrote.

Despite some initial rumors on Friday about how resilient crypto is to tariff news, Bitcoin dropped 5.6 % over the past 24 hours to$ 78,769, or 27 % from its all-time high of$ 108,786 on January 20.

Ethereum dropped 12 % to$ 1, 591, down more than 67 % from its November 2021 peak.

It comes in response to a more general decline in global businesses. U.S. stock futures fell on Sunday night, indicating a possible turbulent market opening.

Japan’s Nikkei 225 dropped as much as 8.9 % on Monday morning in Asia. After reopening, Taiwan’s Taiex index dropped nearly 10 %, causing circuit breakers for major corporations like TSMC and Foxconn.

Additionally, more foreclosures occurred in the crypto industry. Over$ 892 million in jobs were lost over the past 24 hrs, including$ 300 million in Bitcoin long and short positions, according to CoinGlass.

Schiff, a founding partner of Euro Pacific Asset Management, also cited the effectiveness of the Official Trump image coin, saying that it was “appropriate” that it was in decline.  ,

The token, which the president launched earlier this year, has fallen 13.6 % in the past day, trading at$ 7.93, an 89.1 % decrease from its previous high of$ 72.43 on January 19.

Schiff, a long-time critique of the blockchain industry, even expressed worry about what he described as economy leaders’ widespread support for Trump’s business policies.  ,

He wrote,” There are three conceivable interpretations.” 1 ) They’re really this stupid, right? 2 ) They must help Trump’s every move to ensure his continued support. 3 ) They think Bitcoin will benefit from the damage done economically.

Schiff has recently opposed efforts that link government legislation to crypto markets, including the Strategic Bitcoin Reserve plan, and argued that Trump’s involvement in the crypto market could result in significant losses for retail traders.

edited by Sebastian Sinclair

Daily Debrief Newsletter

Begin each day with the most popular media stories right now, along with unique content, a audio, videos, and more.