Although Bitcoin’s price is close to a five-month small, U.S. President Donald Trump’s tariffs have hurt the nation’s largest technology firms more severely.

The largest cryptocurrency by market value has increased since Nov. 5 in comparison to the” Magnificent Seven,” a group of Nasdaq companies that includes top tech companies like Apple, Nvidia, and Tesla.

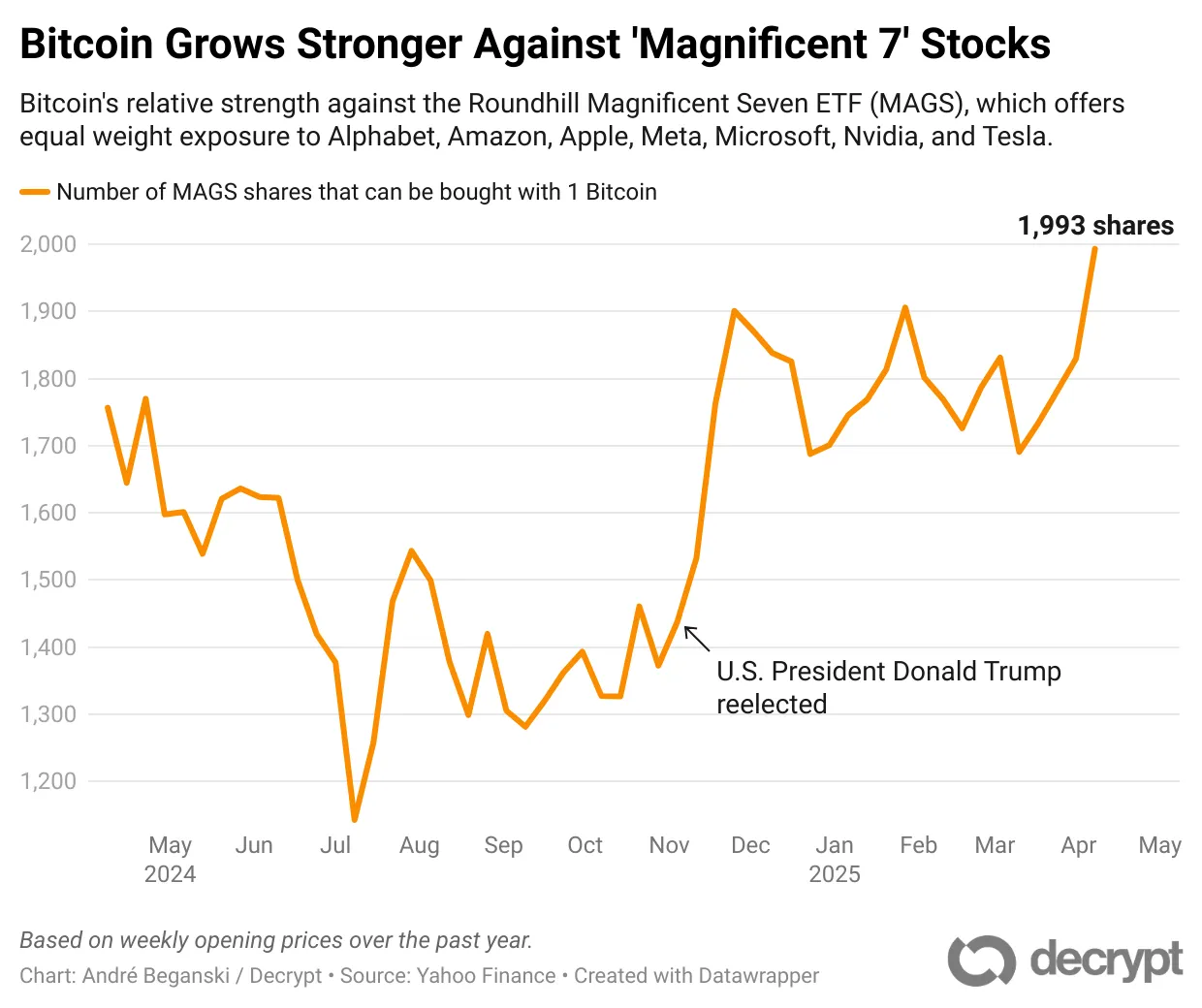

One Bitcoin from the Roundhill Magnificent Seven ETF ( MAGS), which offers the group of tech companies equal weight exposure, was worth about 1, 993 shares on Monday. One Bitcoin could have purchased 1, 756 of the exchange-traded bank’s stock a year ago for$ 69, 000.

The amount on X, formerly known as Twitter, was at an all-time high, according to Matthew Sigel, mind of digital goods study at asset manager VanEck, on Friday.  ,

He continued, citing a well-known abbreviation for mega-cap tech stocks Meta ( formerly Facebook ), Amazon, Apple, Netflix, and Google,” I’ve been telling clients for years to use Bitcoin to hedge FAANG exposure.”

On Monday, Bitcoin’s comparative strength to Magnificent Seven companies reached its highest level in the last year, rising 13.5 % over the course of that time. Despite recently trading like a technical investment, some market participants thought it was a sign of divergence.

Juan Leon, a top investment strategy at Bitwise, told that “in the past business upheaval, Bitcoin has had a combined track record of providing short-term safety.” Is this the moment when it begins to flourish as a tenacious short- long-term store of value?

U.S. companies have endured their worst stretch since the start of the coronavirus crisis as the president has advanced with his trade war. According to Yahoo Finance, the S&, P 500 dropped for a second consecutive time on Monday and has dropped 10 % in the last week.

According to blockchain data company CoinGecko, Bitcoin’s rate dropped to$ 74,600 on Monday, bringing it to a new low for Trump’s next term. Bitcoin is still trading above its Election Day price of$ 69, 000 on November 5, despite the S&, P 500 losing its post-election gains.

These are not record-setting drawdowns, according to Thomas Perfumo, Kraken’s world economist, in contrast to traditional economic shocks or crypto business processes. The advantage class has endured worse and generally emerged stronger each day.

Daily Debrief Newsletter

Begin each day with the most popular media stories right now, along with unique content, a audio, videos, and more.