The LIBRA image coin, which was intended to be a means of funding Argentina, has left a path of run-down wallets and shattered confidence since its release and later collapse.

According to new research from Nansen, a blockchain analytics firm, an$ 11 million caldera of unfulfilled loss was revealed as a result of the consequences.

The LIBRA token’s on-chain aftermath, which had a peak value of$ 4.5 billion before falling, demonstrated that only a small number of cards managed to profit while the majority of traders suffered loss.

” Unrealized losses exceed unrealized gains by$ 4.57 million, highlighting a significantly larger imbalance”, Nansen analyst Nicolai Søndergaard wrote on Wednesday.

Nansen’s study tracked 15, 431 cards trading LIBRA, finding that 86 % of names recorded realized costs totaling$ 251 million, while 2, 101 profitable cards netted around$ 180 million altogether.

A bitcoin” Wild West”

But the harm is more than just numbers.

The collapse of the LIBRA token has broader implications on the blockchain industry, according to Arjun Arora, chief operating officer of the distributed orderbook process Regular Network.

” The scandal reinforces a consensus macro narrative of crypto as a” Wild West” —a space where political influence, insider trading, and lack of transparency can fleece unsuspecting retail investors”, Arora told .

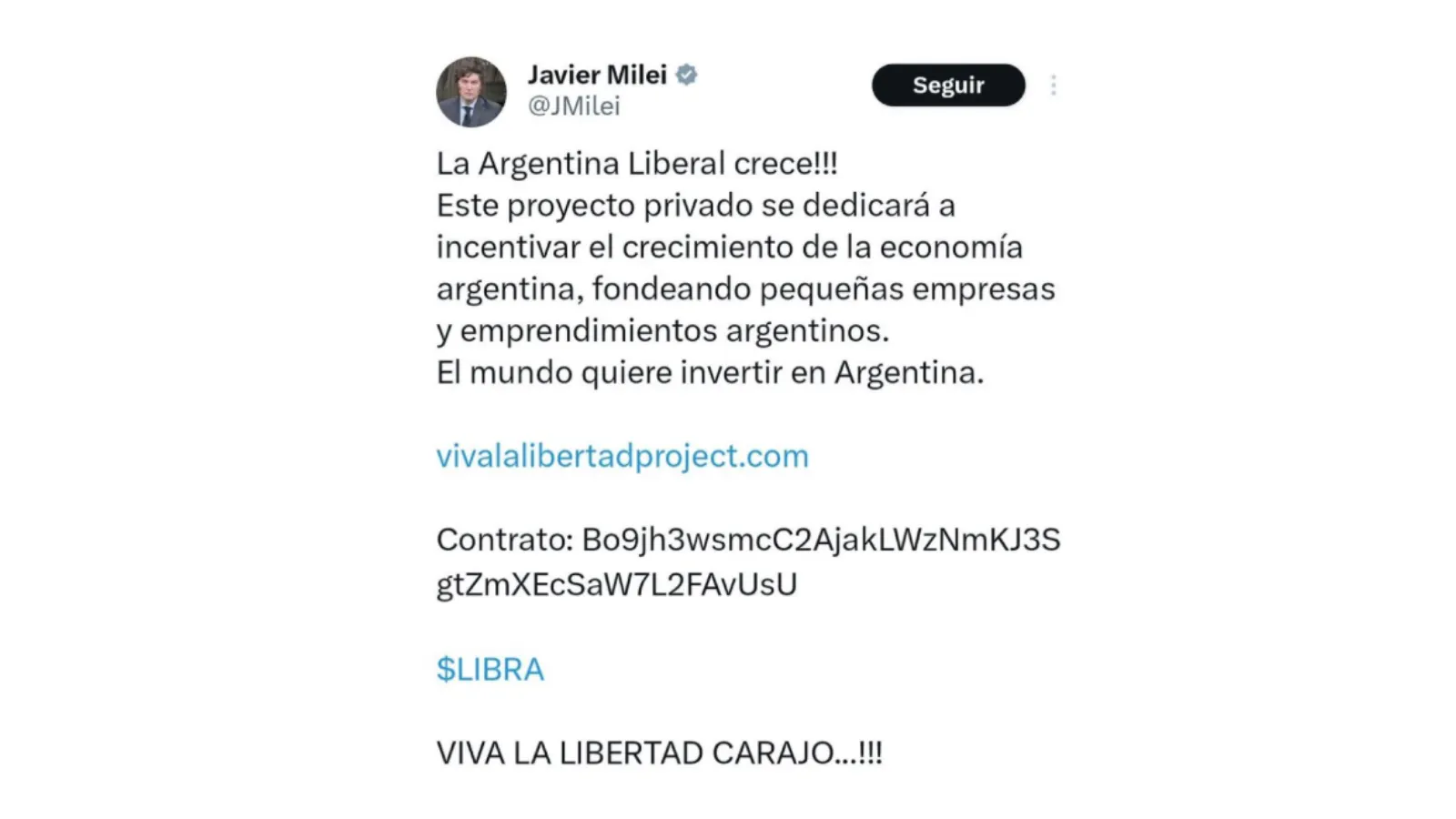

After Argentine President Javier Milei’s now-deleted post about LIBRA, it attracted a lot of attention. First described as a resource to fund small firms in Argentina, it was immediately tagged as” only a joke gold” by Hayden Davis, who claimed to be its “launch planner”.

Days later, fraud claims were leveled against Milei, as Argentina’s stock business dipped following LIBRA’s decline. Afterward, on-chain data revealed connections between the LIBRA token’s creators and Melania Trump’s MELANIA meme coin’s creators.

As the discussion unfolded, Solana experienced cash flows and dropped 8.8 %, facing “repercussions” despite, as Nansen’s studies pointed out, it not being a direct student in the start.

The negative perception following LIBRA’s collapse is “particularly damaging” as the market” seeks mainstream adoption and validity” from retail hands and institutional vaults, so much so that it “pushes against all the hard builders” in the crypto area, Arora opined.

In an effort to close a$ 44 billion deal that could boost Argentina’s economy, Milei arrived in Washington on Thursday morning to meet with IMF chief Kristalina Georgieva.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.