The NFT  business experienced disappointing results in 2024, with sales and trading volumes dropping below their lowest levels since 2020.

According to a report from a blockchain analytics platform, annual trading volumes decreased by 19 %, while sales numbers decreased by 18 % compared to 2023.

Despite a surge in crypto industry action, driven by Bitcoin’s all-time peaks and rising DeFi development, NFTs appeared to fight under the weight of their own inflated prices.

NFT trading volumes increased modestly by 4 % in Q1 to$ 5.3 billion, up from the same period in 2023.

However, this momentum proved fleeting, as volumes plummeted to$ 1.5 billion in Q3 before recovering slightly to$ 2.6 billion in Q4.

Even with these fluctuations, quarterly sales counts fell sharply, pointing to a broader trend: while specific NFTs became more expensive in line with rising bitcoin key prices, general business wedding dwindled.

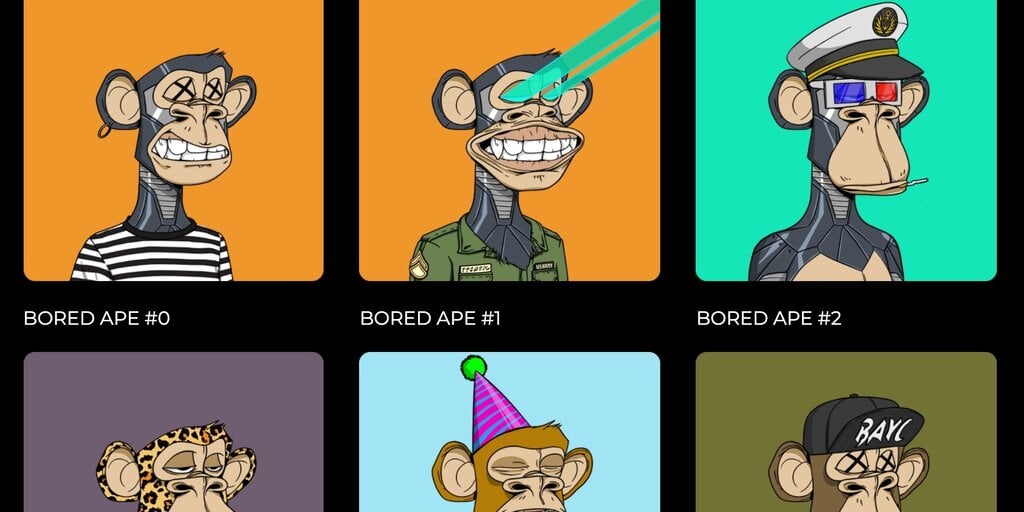

Yuga Labs ‘ flagship collections Bored Ape Yacht Club ( BAYC ) and Mutant Ape Yacht Club ( MAYC ) hit historic lows, with floor prices dropping to 15 ETH and 2.4 ETH, respectively.

Yet Otherdeeds for Yuga Labs ‘ Otherside universe plummeted to 0.23 ETH,  , a far cry from their initial coin rate, exposing breaks in Yuga’s high-priced, membership-driven design.

This coincided with DappRadar’s study that” Perhaps 2024 helped us know that NFTs don’t need to be expensive to show their value in the broader Web3 ecosystem”, a criticism of the market’s emphasis on luxury and inflated prices.

Amid this downturn, the NFT market witnessed a paradox in November when CryptoPunk #8348, a rare seven-trait collectible from the NFT collection, was collateralized for a$ 2.75 million loan via the NFT lending platform GONDI.

When juxtaposed with DappRadar’s insights about affordability and utility, this event exhibited speculative excess in contrast to what was billed as a milestone for NFTs as financial assets.

While prominent transactions like these aim to affirm NFTs ‘ worth, they also highlight a market that is still fueled by exclusivity and inflated prices, even as greater participation declines.

Blue-chip collections like CryptoPunks defied trends, nearly doubled their USD value in 2024, with notable sales driving brief recovery periods.

The largest share of trading volume was dominated by NFT platforms like Blur, which used zero-fee trading and aggressive airdrop campaigns to dominate the marketplace.

In contrast, rival marketplace OpenSea struggled with regulatory headwinds and declining market sentiment, forcing significant layoffs by year-end.

By Q4, Blur and OpenSea were neck-and-neck in market share, but Blur’s ability to generate high activity from a smaller, more active user base gave it the edge, as per the report.

While trading volumes in late 2024 hinted at a potential recovery—November sales hit$ 562 million, the highest since May—the overall trajectory suggests that affordability, accessibility, and utility will be critical for sustained growth in 2025.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.