In a nutshell

- The UK shared fresh draft rules and regulations for the crypto market.

- The regulations aim to boost investment confidence while safeguarding buyers.

- In the UK, about 12 % of people owned bitcoin as of August 2024.

The UK government’s recently released draft legislation aims to make clear, fresh crypto regulations that will help investors feel secure while keeping them safe while doing so.

A 27-page review of the Financial Services and Market Act 2000’s Order 2025 and an accompanying policy explaining highlight new meanings for crypto property like stablecoins and introduce regulations like enforcing crypto assets and running crypto exchanges.

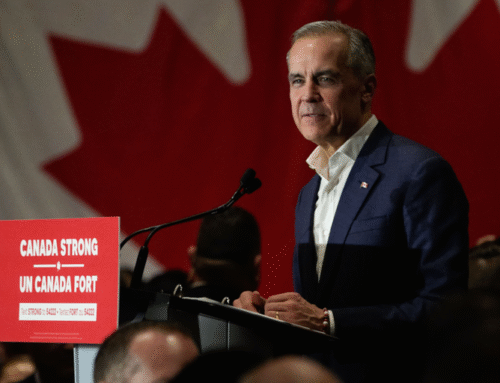

In a statement, UK Chancellor of the Exchequer Rachel Reeves said,” We are making Britain the best place in the world to innovate and the safest place for consumers. Strong crypto-related laws will boost investor confidence, promote financial development, and safeguard citizens in the UK.

The document, which was made public to check for any errors or oversights, seeks to alter some of the Financial Services and Market Act’s rules, including Order 2001, which specifies regulated activities.

The Regulated Activities Order (RAO ) amendments aim to define what constitutes a specified investment, regulate certain activities related to the assets, and define what constitutes a qualifying stablecoin and crypto asset.

Crypto exchanges, dealers, and agents will be included in the new regulations, allowing them to defy the government’s regulations while supporting legitimate innovation, according to His Majesty’s Treasury and Reeves ‘ statement.

It further states that” Crypto companies with UK consumers will also have to adhere to high standards for transparency, consumer protection, and operational resilience, just like they do with traditional banks.”

Carter and U.S. Treasury Secretary Scott Bessent exchanged recent draft policy, which included conversations about “greater cooperation on modern stocks between the UK and US.”

In a conversation with the UK Treasury in 2023, there were specific suggestions for stabilcoin-related crypto asset regulation. The authorities stated its intentions to put those proposals into practice last November, and today’s speech states that it” may bring forth last crypto asset policy at the earliest chance, following engagement with industry regarding the draft provisions.”

A novel crime bill was introduced in the UK in February that gave more power to crypto seizures.

According to research from its Financial Conduct Authority, about 12 % of UK citizens were crypto owners as of August 2024, up from 4 % in 2021.

edited by Andrew Hayward

Daily Debrief Newsletter

Start each day with the most popular media stories right now, along with unique content, a audio, videos, and more.