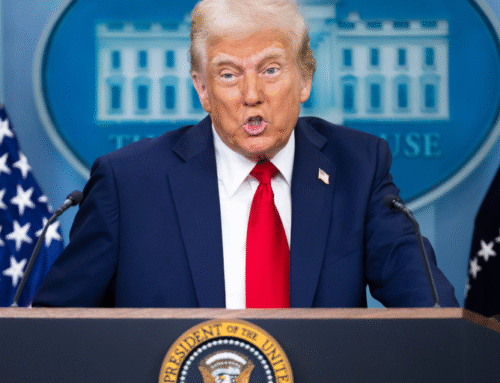

It’s still too early to determine how the central bank’s monetary policy will be affected by Donald Trump’s taxes, but the Federal Reserve anticipates that they will spur inflation.

Jerome Powell, the head of the Federal Reserve, delivered that message on Wednesday while speaking to the Economic Club of Chicago in a careful manner.

He said,” The level of price increases announced so far is substantially larger than anticipated, and the same is likely to be true of the economic results.” ” We might find ourselves in the difficult situation where our two mandates conflict.”

According to the crypto data provider CoinGecko, the price of Bitcoin dropped during Powell’s remarks, falling 1.5 % to$ 83,700 in about 90 minutes. Recently, Bitcoin’s price changed hands to about$ 83,800, down 0.5 % over the previous 24 hours.  ,

According to Yahoo Finance, the S&, P 500 briefly slowed down, falling 2 % midday after recovering from steeper costs earlier in the day.

It’s very soon to say is becoming a constant theme in Powell’s statements, according to Juan Leon, a top investment analyst at Bitwise, for . It’s too late to fix, I hope that doesn’t change into” I hope that doesn’t change out.” ‘”  ,

According to Leon, Leon said that the market believes the Fed is underperforming, which suggests a wait-and-see approach could throw the Fed in a difficult place given how the market perceives its actions as trailing behind the curve given Wednesday’s price action.

Powell noted that while growth forecasts predict a decline, they are also good. He added that Trump’s taxes are “highly likely to cause at least a temporary rise in inflation,” but it’s not clear whether those effects could also be more regular.

Since Trump last week reduced “reciprocal” tariffs to 10 % for most countries, economists ‘ odds of a recession in the U.S. have decreased. Traders are eager to understand how escalations might affect the Fed’s rate cut math given that Trump’s business efforts are centered on China.

Fed policymakers scheduled two price cuts for the current time at their March plan gathering, but Fed futures traders anticipate that the central banks will need to implement more stimulative measures. According to CME FedWatch, merchants foresaw four price reductions in 2025 following Powell’s notes.

When asked about the regulatory environment surrounding crypto, Powell said there was “mainstreaming of that entire sector,” and that cryptocurrencies might be a” fine idea” as a product with “fairly wide appeal.” Powell did not specifically address Bitcoin, but he emphasized customer protections.

In the wake of Trump’s trade war, bitcoin has acted more like a chance asset than a safe haven, but persistent changes in the world economic order may change that active, according to Messari researcher Dylan Bane. Trump’s thick levies, he claimed, could act as a motivator.

He said that as tariffs “reduce global trade and stress global teamwork,” they likewise “beginned to undermine the foundations that support the US currency’s role as the world’s reserve currency.”

Daily Debrief Newsletter

Begin each day with the most popular media stories right now, along with unique content, a audio, videos, and more.