The multibillionaire hedge fund manager and Bitcoins fan Ray Dalio has warned that the United States might experience” something worse than a recession” in the near future.

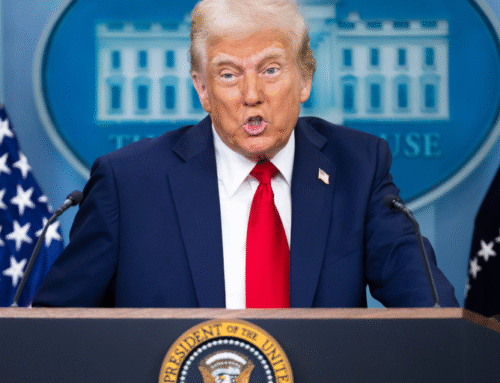

The Bridgewater Associates leader, speaking to NBC’s Meet the Press, claimed that Donald Trump’s extreme trade policy is causing the “breaking down of the economic order”

Dalio, who anticipated the 2008 crisis, expressed concern about the value of money and predicted that there could be” an international issue in a way that is very disruptive to the planet economy” unless the government’s economic policies are followed.

He continued,” This kind of breakdown just occurs about once in a lifetime,” while highlighting the seriousness and relevance of recent developments.

The government’s plans to impose levies on foreign goods have raised a lot of questions for Bitcoin and Ether’s amount, with Beijing bearing the brunt of Trump’s indignation.

However, after the White House confirmed that smartphones and computers would be exempt from these tariffs, including those made in China, BTC surged back up to$ 85,000.

The news, according to Wedbush scientist Dan Ives, is a “huge triumph for big tech and technology investors” and will have a significant impact on the stock market on Monday.

Digital property investment products have experienced a second straight month of declines, with outflows of$ 795 million as a result of a new CoinShares report.

There is only a 61 % chance that BTC will be trading above the current$ 85, 000 mark by the end of Wednesday, according to Myriad Markets, and traders on prediction markets appear divided on what lies ahead.

However, older product planner Mike McGlone from Bloomberg Intelligence noted that BTC’s 9 % year-to-date losses contrast strongly with gold’s 25 % increase over the same time frame.

In a statement seen by , he wrote that Bitcoin and its millions of bitcoin children may need to experience buoyancy as the U.S. stock market rises. The Bitcoin/gold ratios might be moving to a simpler track, or reverse.

edited by Stacy Elliott.

Daily Debrief Newsletter

Begin each day with the most popular media stories right now, along with unique content, a audio, videos, and more.