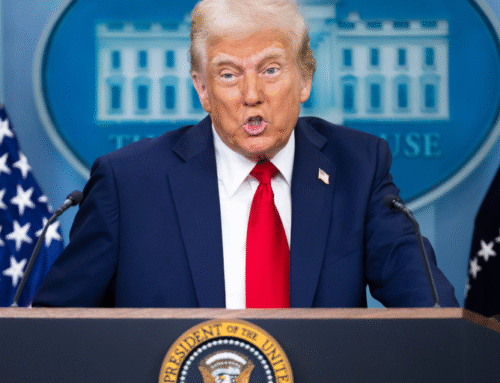

Nearly 200, 000 Paypal shares were added over the course of the past three buying time as markets sagged as a result of President Trump ‘s , business battle, according to CNNd technology investor Cathie Wood and her actively managed Ark Invest ETFs.

The top-tier American crypto exchange’s stock was purchased by the Ark Innovation ETF ( ARKK), Ark Next Generation Internet ETF ( ARKW), and Ark Fintech Innovation ETF ( ARKF), which were the top three stocks in total additions of 83, 157 shares on April 4 and 84, 514 shares on April 7. The group added 31 more 730 stock in total on Tuesday.  ,

As of April 9, Wood’s Ark Invest ETFs had a total of 3, 071, 038 million securities of Bitcoin on file. That stash is worth about$ 550 million based on the current COIN price of just under$ 180 per share, with COIN and other stocks rising on Wednesday afternoon as a result of President Trump’s announcement to allow a 90-day pause on most of his “reciprocal” trade tariffs.

At the end of 2024, Ark ranked near the top of all administrative holders of the property and has a long story with blockchain and shares of Coinbase. Around that time, the company sold nearly$ 4 million worth of shares, and in early 2024, a much larger portion for$ 52 million.

The company regularly rebalances its funds, buying and selling stocks as a result, making the Gold picks for Ark not unusual over the past three buying days.

Some analysts see reason for optimism, despite COIN’s nearly 28 % decline since the start of the year.

According to a report from Cantor Fitzgerald on Tuesday, Wall Street may have overlooked the property because of its connections to USDC, Base, and Circle, a stablecoin supplier, and Base’s Ethereum layer-2 network. As a result, the company’s analysts assigned COIN an” Overweight” rating along with a$ 245 price target, which is a 36 % increase over the current price as of this writing.

edited by Andrew Hayward

Daily Debrief Newsletter

Begin each day with the most popular media stories right now, along with unique content, a audio, videos, and more.